tax agent e filing

The IRS reminds all active federal tax return preparers they must renew their Preparer Tax Identification Numbers PTIN now for 2022. Anyone who prepares or helps prepare a federal tax return for compensation must have a valid PTIN from the IRS.

Tax Preparation Services Individual Tax Preparation Business Tax Preparation Tax Accountant Woodbury Mn St Paul Mn Minneapolis Mn Twin Cities Metro Area Aba Tax Accounting

An agent who does not pay regular wages to you may choose to withhold income tax at a flat rate.

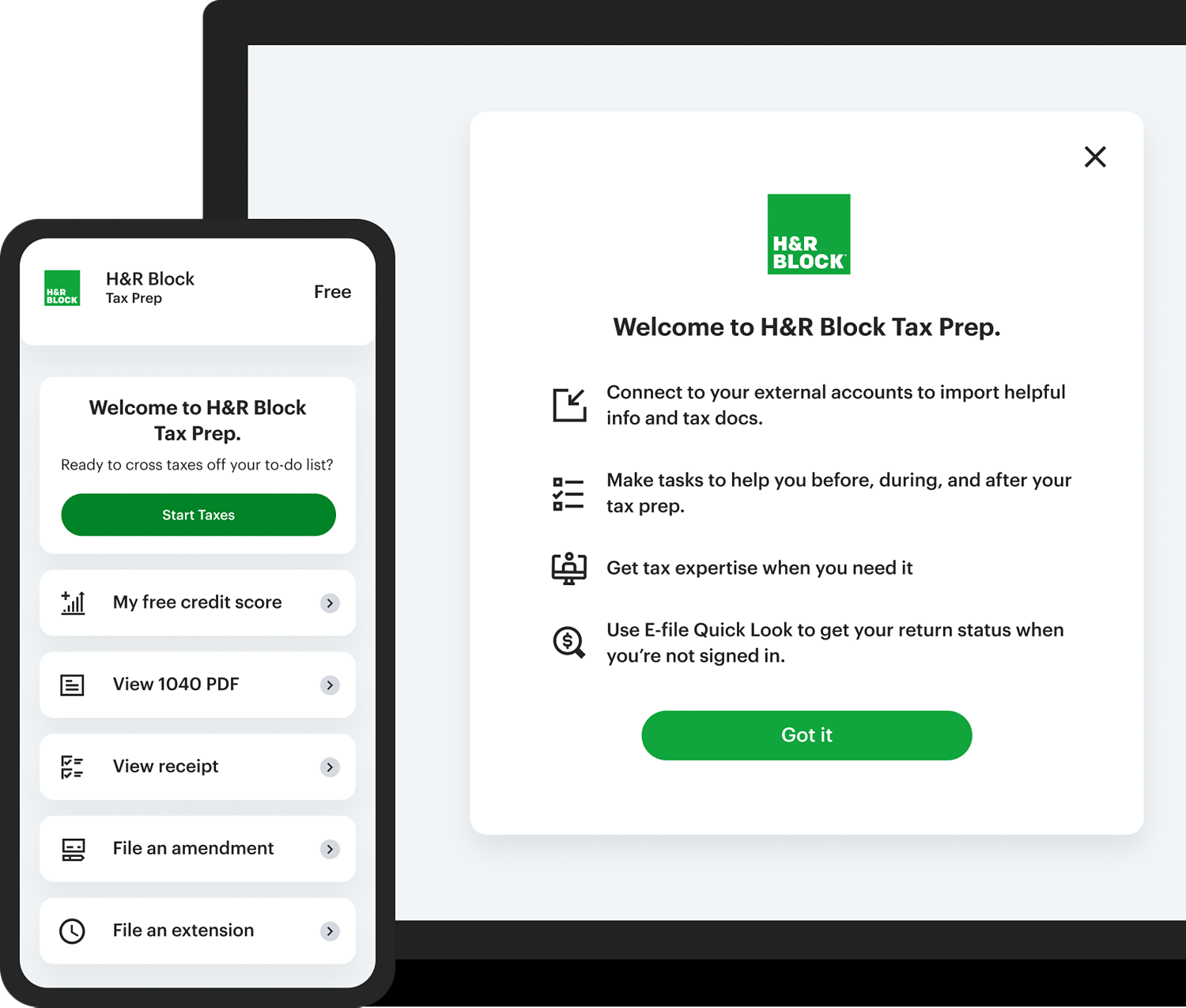

. By authorizing HR Block to e-file your tax return or by taking the completed return to file you are accepting the return and are obligated to pay all fees when due. Courses focused on enhancing tax professional awareness of protecting client data including review of Publications 4556 or 4524 safeguards can qualify for continuing education in the federal tax law category. 1993 the Eighth Circuit rejected taxpayers argument that filing federal income tax returns and paying federal income taxes violated his pacifist religious beliefs because he had no First Amendment right to avoid federal income taxes on religious grounds Wall v.

HR Block Maine License Number. HR Block Maine License Number. Enrolled agent status is the highest credential the IRS awards.

Over 14200 but 54200. All current PTINs will expire December 31 2021. See todays top stories.

For e-filing system questions call the BSA E-filing Help Desk at 866-346-9478 option 1 Monday-Friday 8 am. If taxable income is. Penalty on late filing.

If you receive sick pay from your employer or an agent of your employer income tax must be withheld. This applies whether you are a resident COMAR 03040202 or nonresident COMAR 03040203 of the State of Maryland. Generally you are required to use the same filing status on your Maryland income tax return as used on your federal income tax return or the filing status that you would have used if required to file a federal income tax return.

The clients of a tax agent can be individuals or entities. See terms and conditions for details. Tax agents prepare the annual tax returns of income for 10 or more taxpayers.

What is Tax. Child tax credit improvements for 2021. 10 of the taxable income.

It is a final tax ie. See terms and conditions for details. - Joe A - Texas.

Tax professionals urged to step up security as filing scheme emerges. CPEOs 3504 Agent Form 941 PR. The Tax Cuts and Jobs Act TCJA added section 1446f which generally requires that if the gain on any disposition of an interest in a partnership would be treated under section 864c8 as effectively connected gain the transferee purchasing an interest in such a partnership from a non-US.

Unlimited help from a tax expert enrolled agent or CPA. Professional that carries out a service. See terms and conditions for details.

Tax professionals should review Publication 4557. Tax professionals can now earn CE credit for programs covering data security and identity theft topics. Eastern time or email at bsaefilinghelpfincengov.

Planilla para la Declaración Federal. Unlimited help from a tax expert enrolled agent or CPA. A qualifying expected tax refund and e-filing are required.

Application of child tax credit in possessions. Notice of Assessment You may only re-file onceRe-filing must be done within 7 days of your previous submission or before 18 Apr whichever is earlier. CGT is tax that is levied on transfer of property situated in Kenya acquired on or before January 2015.

A qualifying expected tax refund and e-filing are required. 5 of the tax due and a late payment interest of 1 per month on the unpaid tax until the tax is paid in full. Ramsey 992 F2d 831 833 8th Cir.

When you re-file you must include all your income details excluding information provided by employers participating in the Auto-Inclusion Scheme AIS for Employment Income and. Guidance under section 1446f. Further you can also file TDS returns generate Form-16 use our Tax Calculator software claim HRA check refund status and generate rent receipts for Income Tax Filing.

See terms and. An enrolled agent is a person who has earned the privilege of representing taxpayers before the Internal Revenue Service by either passing a three-part comprehensive IRS test covering individual and business tax returns or through experience as a former IRS employee. Re-filing before receipt of your tax bill ie.

Scammers use the regular mail telephone or email to set up individuals businesses payroll and tax professionals. Visit Report of Foreign Bank and Financial Accounts FBAR Foreign Account Tax Compliance Act FATCA and FATCA Information for Individuals for more information. Start e-filing your Form 941 with TaxBandits and Get Instant Approval from the IRS.

Whichever is higher between 5 of the tax due or Kshs. By authorizing HR Block to e-file your tax return or by taking the completed return to file you are accepting the return and are obligated to pay all fees when due. IRS Tax Tip 2021-160 October 28 2021.

Making joint or separate estimated tax payments wont affect your choice of filing a joint tax return or separate returns for 2022. A qualifying expected tax refund and e-filing are required. A tax agent must have a myIR account.

Individual Income Tax Returns should be filed on or before 30th June of the following year. Penalty on late payment. PART 3--Earned Income Tax Credit Sec.

A tax agent can be a. WTOP delivers the latest news traffic and weather information to the Washington DC. Ive tried other tax filing services and TaxBandits is by far the absolute best.

You can efile income tax return on your income from salary house property capital gains business profession and income from other sources. It is declared and paid by the transferor of the property Rate of Tax. To help you identify and stop fraud the Tax Contact of your business will get an email noting any changes made to your business record with the Secretary of States OfficeAccounts are monitored daily and any information changed under the Contact Registered Agent Manager LLC Officer Corp Sections will trigger an email.

Thousands of people have lost millions of dollars and their personal information to tax scams. The rate of tax is 5 of the net gain. PART 2--Child Tax Credit Sec.

The deferral also applies to deposits of the employers share of Social Security tax that would otherwise be due after December 31 2020 as long as the deposits relate to the tax imposed on wages paid a during the quarter ending on December 31 2020 for employers filing quarterly employment tax returns or b during the payroll tax. Strengthening the earned income tax credit for individuals with no qualifying children. 1420 plus 12 of the excess over 14200.

By authorizing HR Block to e-file your tax return or by taking the completed return to file you are accepting the return and are obligated to pay all fees when due. The tax due is. A qualifying expected tax refund and e-filing are required.

Person in a business where income tax returns are prepared. The Capital Gain is not subject to further taxation after payment of the 5 rate of tax. Transferor must withhold a tax equal to 10 of.

Starting at Get help from a live tax pro.

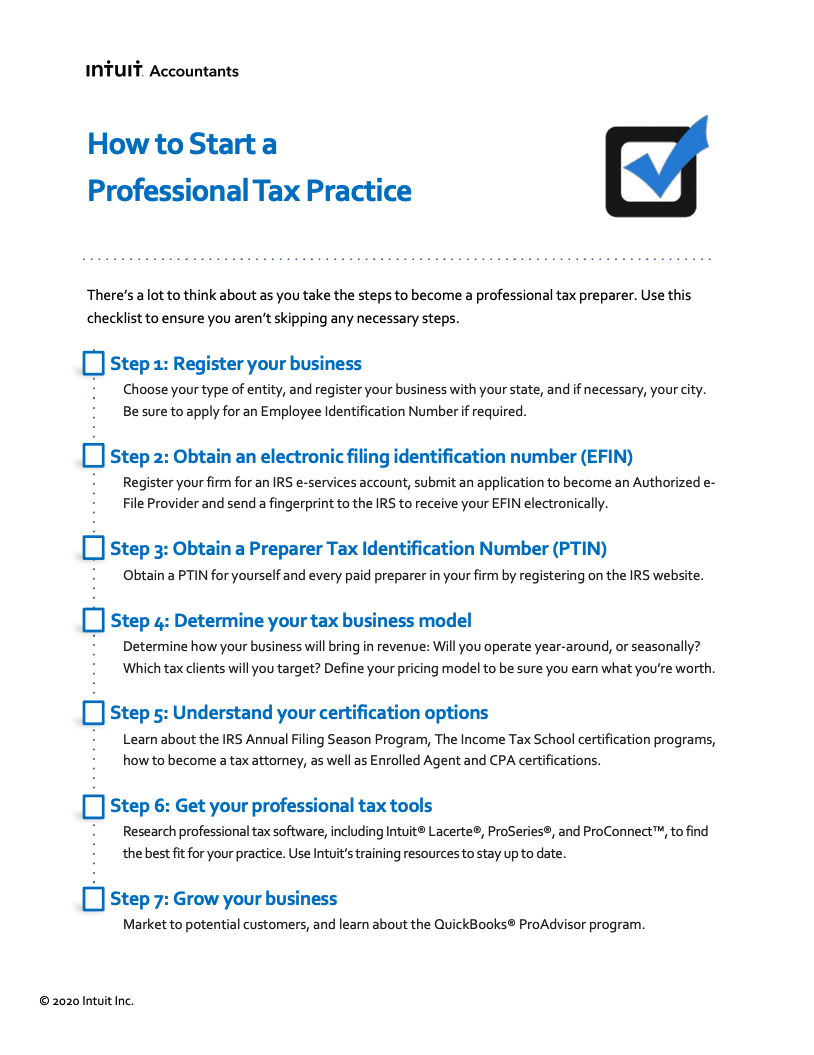

Start Your Own Professional Tax Practice Intuit Proconnect

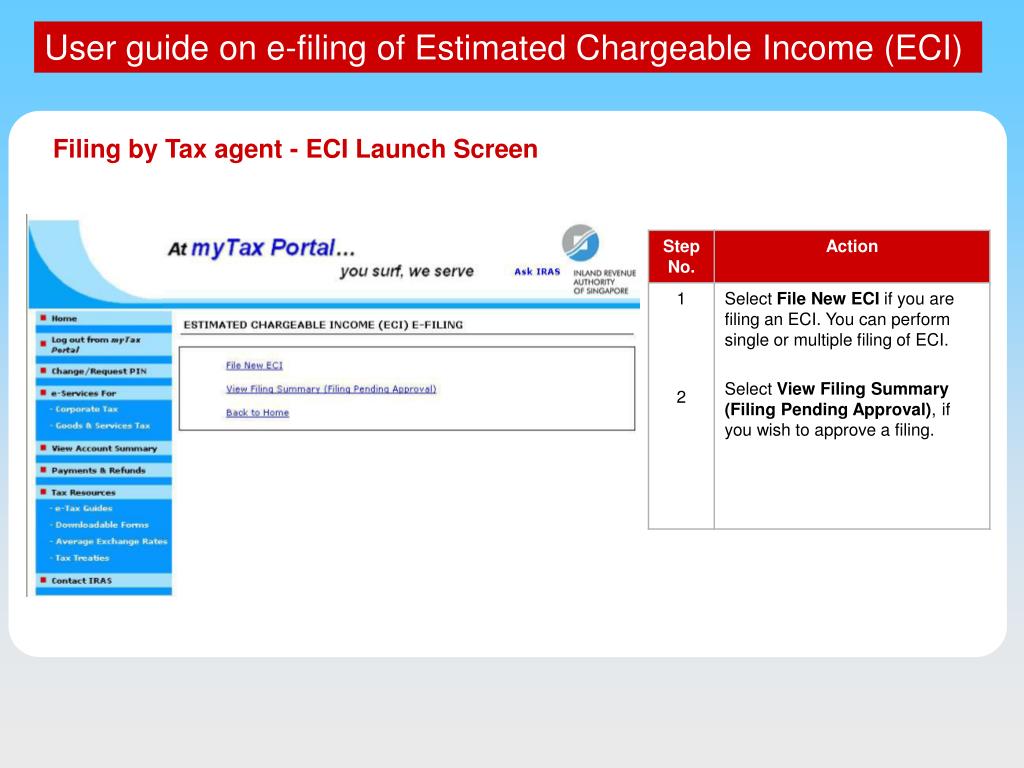

Iras The Availability Of E Filing For Form C S C Means That Companies Can Go Paperless When It Comes To Tax Matters We Are Pleased That Tax Agent Firms Have Continued To

Tax Agent Service Abstract Concept Vector Illustrations Stock Vector Illustration Of Appointment Refund 231300955

E Filing Can Make High Fee Loans Unnecessary

Efile For Tax Professionals Internal Revenue Service

Tax Agent Service Abstract Concept Vector Illustration Money Refund Income Statement And Financial Audit E File Online Software Man Raises Money Personal Financial Advisor Service Concept Stock Vector Adobe Stock

Free Online Tax Filing E File Tax Prep H R Block

19 018 E Filing Stock Vectors Images Vector Art Shutterstock

.png?sfvrsn=34046ffe_3)

Iras Tax Season 2022 All You Need To Know

E File Taxes Cut Out Stock Images Pictures Alamy

E Filing As Reporting Agent For Your Clients Using Same 5 Digit Pin In Quickbooks Desktop Payroll Youtube

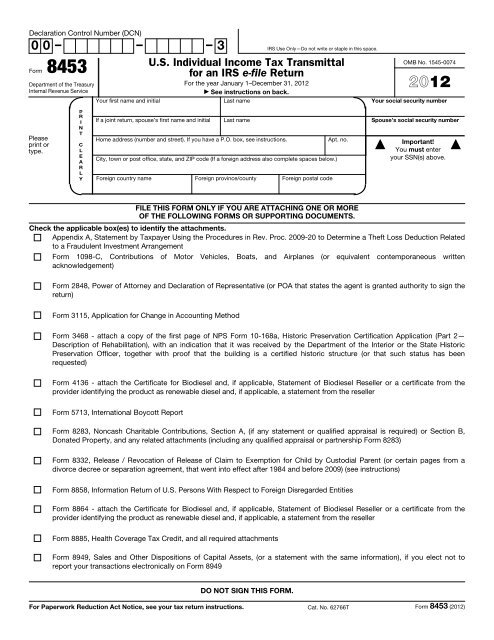

U S Individual Income Tax Transmittal For An Irs E File Return

How To File An Extension For Taxes Form 4868 H R Block

Six Reasons To E File Your Taxes In 2017 Northeast Financial Strategies Inc

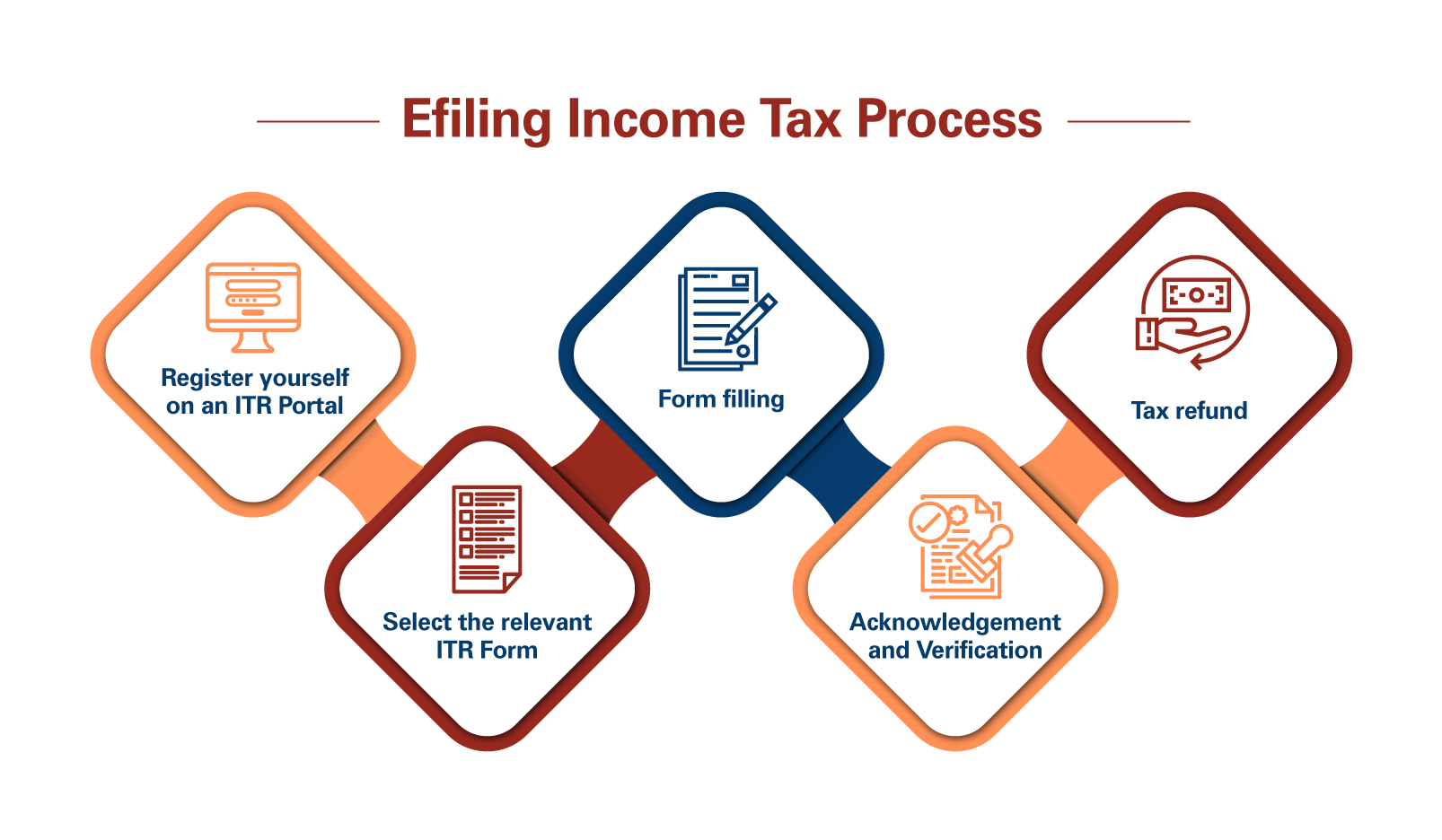

Efiling File Income Tax Returns Online In India 2022 23 Icici Prulife

A N Management Services E Filing Partnership Tax E Filing Is Now Available For Partnership Tax Facebook

:max_bytes(150000):strip_icc()/tax-documents-to-the-irs-3973948-0d372f2897a34944abb220e99cca25ce.jpg)

Comments

Post a Comment